financial models

Over 4k fully functioning models to power your research

Spend less time searching for data or building models and more time on needle-moving, alpha-generating analysis.

Spend less time searching for data or building models and more time on needle-moving, alpha-generating analysis.

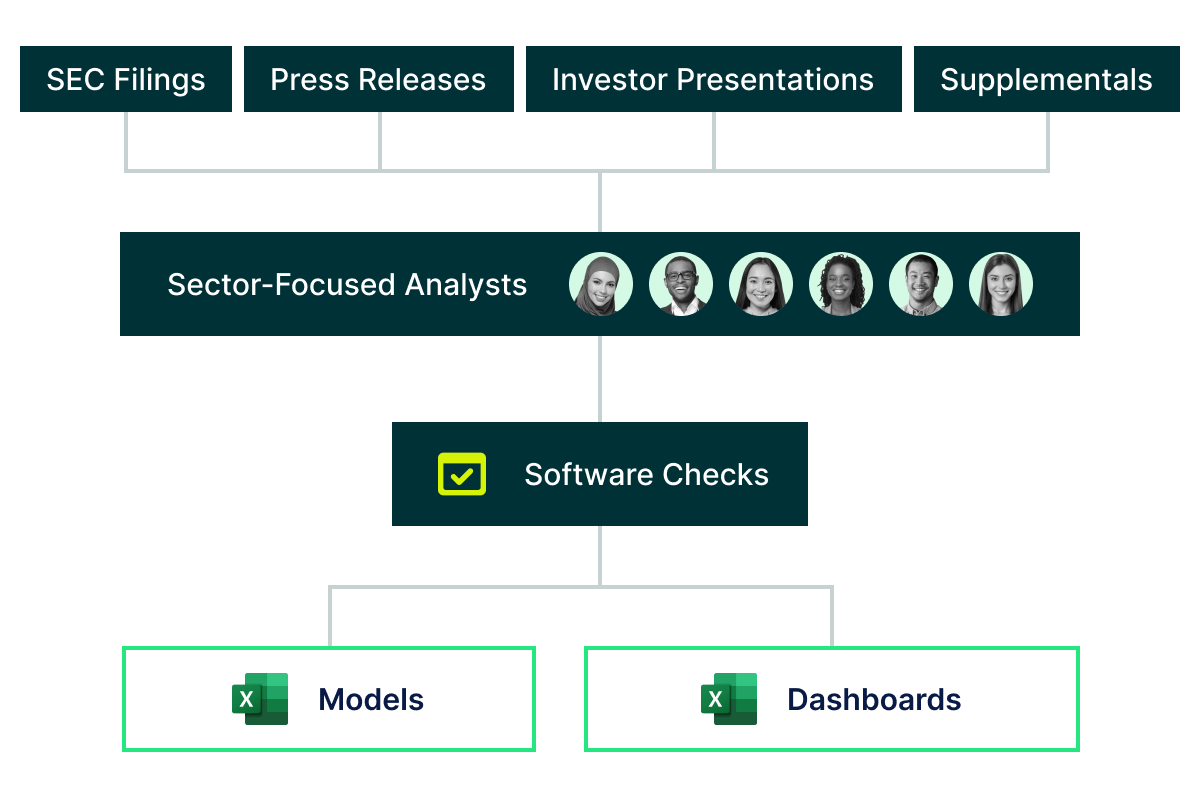

Our analysts comb through filings, press releases, investor presentations, and more to create models powered by the cleanest fundamental dataset in existence, letting you focus on analysis and spend less time doing what everyone else is doing.

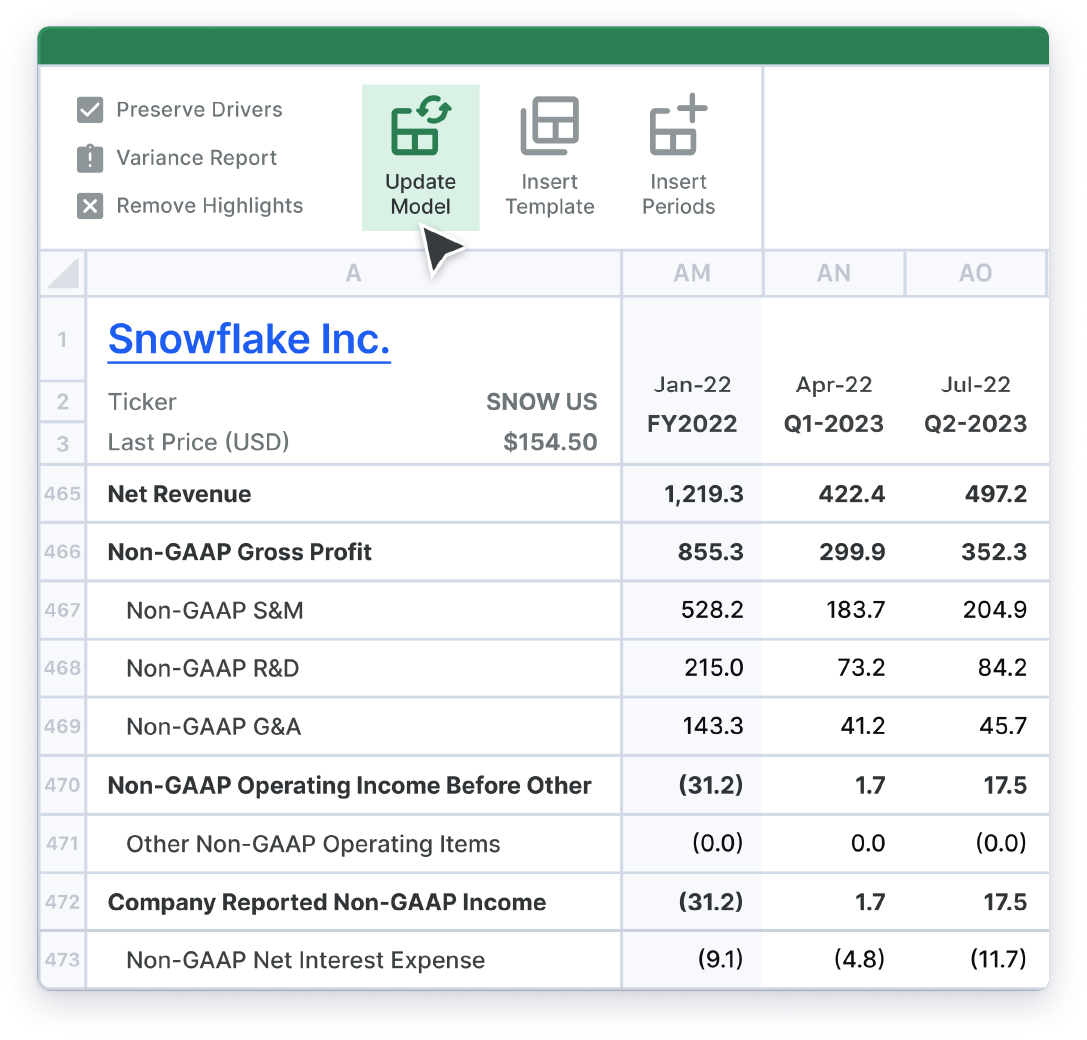

Each of our models is hand-built by our team of analysts and ready to use right off the shelf with internal linking, company-specific drivers, editable forecasts, and every recurring publicly-available KPI that a company reports. Tailor them to your needs by changing drivers and formulas, adding rows and tabs for additional data and analyses, hiding rows or columns you don’t want to see, and customizing formatting.

Our Vancouver-based team of over 100 sector-focused analysts sources data directly from the filings, press releases, investor presentations, and supplementals, capturing data others miss like restatements, resegmentations, M&A transactions, and guidance. Finally, every datapoint goes through hundreds of proprietary software checks before it gets published to ensure accuracy.

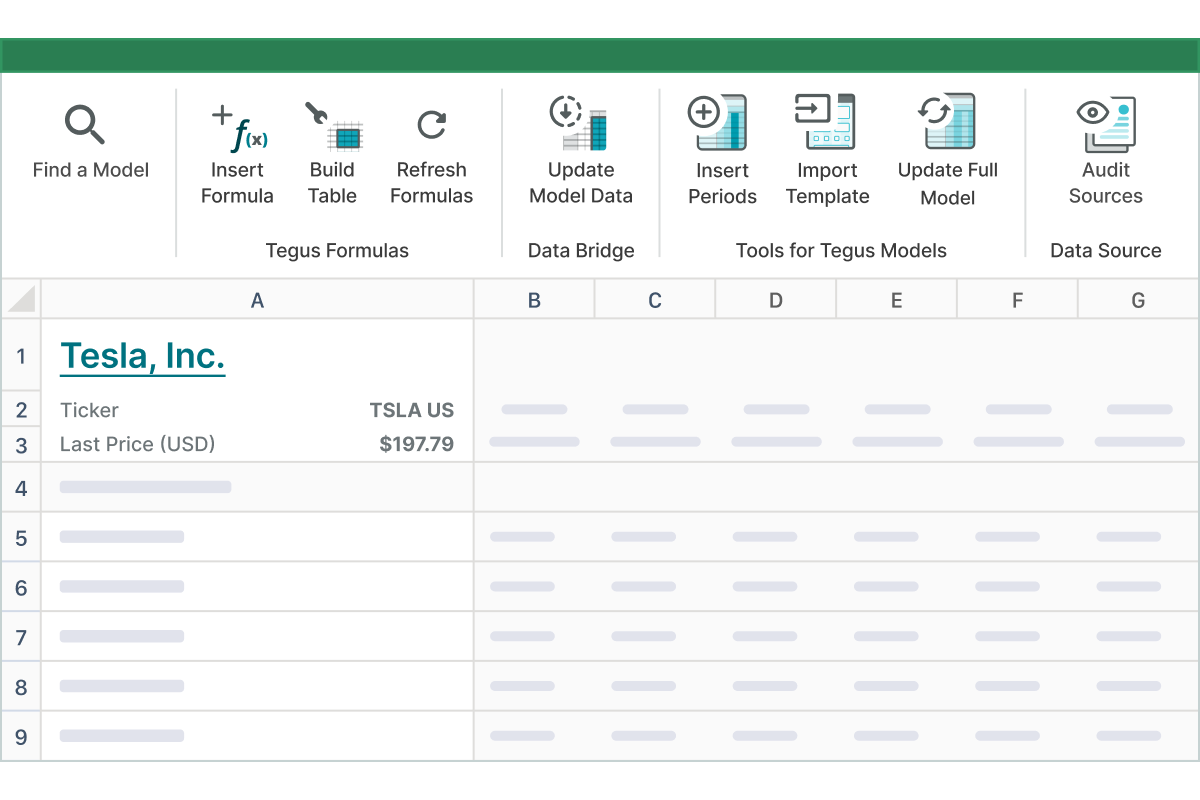

The Tegus Excel Add-In brings all the power of Tegus Analysis into Excel, letting you update your models with the most recent data in just one click; search for and download models; add drop-in templates like DCF, LBO, and M&A; and so much more without ever having to leave Excel.

6,000+

Expert Calls per Month

36,000

Public & Private Companies Covered

200K+

Expert Call Transcripts

No one else can provide an end-to-end platform for my investment research like Tegus does. I can download accurate financial models, easily access filings and earnings calls, dig into a database of expert insights, and procure my own expert calls all within the platform. I get time-savings without compromising on quality.

Alex Wolf

Managing Director, IGSB